By the end of this article, you’ll have the information you need to make a decision on the right account reconciliation software for you and your business. Upflow provides a convenient solution for your accounts reconciliation system. With greater control https://www.business-accounting.net/amazon-seller-accounting-what-is-the-best-way-to/ and visibility over your bills and invoices and integrated payment methods, you can count on a reliable way to reconcile your accounts. Upflow allows you to easily track all your incoming and outgoing expenses and reconcile your transactions.

QuickBooks Self-Employed

We considered customer support for customers who might need technical support in using the software. Customers must have access to different support channels for maximum flexibility. We recommend that you go with QuickBooks Online if you’re looking for an easier and more affordable option. The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions.

What is the best way to reconcile bank accounts?

Unlike some competitors that require you to pay extra for a time-tracking module, all FreshBooks plans come with unlimited time tracking. You can start a timer from within the mobile app to log hours spent on a particular project or sync data from tools like Asana and Trello. Robust feature set includes thorough record-keeping, comprehensive reporting, excellent invoicing and inventory management, plus a capable mobile app.

Discover Our Financial Close Solutions

FloQast automatically tracks timing and unknown errors to ensure all reconciling items are recorded, tracked and managed in one place. Ambitious finance leaders engage with Prophix to drive progress and do their best work. Multiview ERP vs. ProphixMultiview ERP’s limited integrations can make it tough to centralize all your data for account reconciliation. Sage Intacct vs. accounting for warranty expense ProphixWorking with historical data can be more challenging with Sage Intacct than Prophix, meaning simple errors can cause issues with account reconciliation down the line. Note that most features important for account reconciliation are only available with the Essentials plan and up. That’s why many organizations turn to a dedicated platform to automate their processes.

Streamline Financial Processes

- However, account reconciliation can be an incredibly time-consuming and complex process, especially if you’re using traditional, manual methods.

- Xero’s online accounting software allows you to see your cash flow in real-time through an easy-to-use interface.

- With FloQast, the auditors can access explanations for reconciling items and view evidence for control execution with read-only user access.

- Consider one of the following solutions if those on our list above don’t suit your small-business accounting needs.

Ideally, the best account reconciliation software offers essential features, such as automatic matching, bank feed connections, customized bank rules and accounting integration. If you don’t need to reconcile accounts frequently, then you may find NCH Express Accounts a good fit. You may do well with its bank reconciliation features as long as you don’t require detailed line items and complete visibility to specific transactions. This makes it a great option for small businesses with simple financial transactions, such as a retail store with daily sales and regular bank deposits. Below, we sum up how the six best bank account reconciliation software programs differ in terms of key features and pricing.

One integrated solution for high volume transactional matching and financial close management

It can pull information from your general ledger and disparate data sources like banks, suppliers and more to reconcile your accounts quickly. QuickBooks vs. Prophix Do you want accounting software that also doubles as an account reconciliation platform? Or do you want a dedicated financial performance platform that’s built specifically to help you close your books, reconcile accounts, and optimize every financial process your organization depends on?

QuickBooks Online also offers three levels of a payroll add-on, which can be accessed on the same dashboard as the accounting software. Additionally, there are third-party apps that can integrate with QuickBooks Online to share data seamlessly. Alternately, accountants who are registered with QuickBooks are able to offer their clients preferred subscription pricing. All plans can be used online through a web browser and on the QuickBooks mobile app.

By automating the process of tracking expenses, it is easier to collect and categorize tax-deductible expenses, which allows for major tax savings each year. Most software systems allow for teams to upload supporting documents, view company policies, electronically sign off on reconciliations and leave comments, if needed. It also allows for controls to be set up so that processes are gated between employees for audit and compliance requirements.

This makes it a great option for larger businesses with complex payment processing and multichannel transactions and those operating in specialized industries, such as banking and finance. Xero, such as QuickBooks Online, is a general bookkeeping software with built-in bank reconciliation features. Its reconciliation tool is not as robust as that https://www.quick-bookkeeping.net/ of QuickBooks Online, but it provides an easy and efficient way to reconcile your accounts. Xero is affordable and easy to use, and you can set up an unlimited number of users in all its plans. A relatively inexpensive alternative to QuickBooks, Sage Accounting is a fairly popular bank reconciliation software with other accounting solutions.

The dashboard is visual and user-friendly; you can refer to it any time and get an updated view of your performance. For more information about the software’s reconciliation tool and other features, head to our detailed QuickBooks Online review. BlackLine’s bank reconciliation services are more suited to mid-size and large companies.

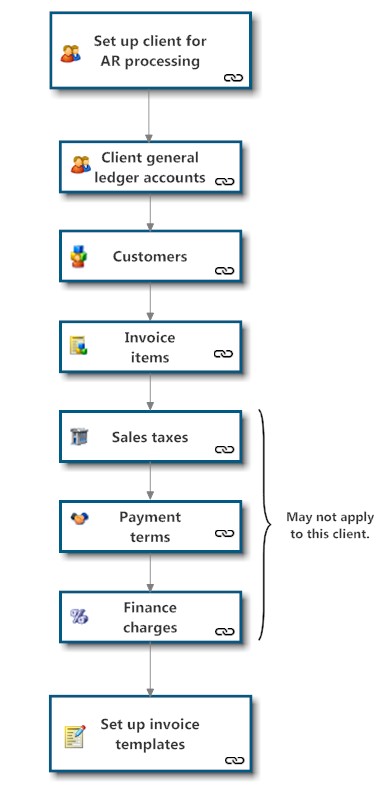

You can get the same functionality from Prophix and handle other key finance processes on one platform. This platform is built with collaboration in mind, and automation allows the Office of the CFO to streamline any financial process, including account reconciliation. While most—if not all—organizations would benefit from account reconciliation software, it might not always be the most pressing software acquisition on your list. Ensuring that your general ledger is accurate is the first step for many other financial processes. Month-end or year-end close, forecasting, and budgeting depend on having accurate figures for revenues, expenses, and more. But beyond being essential for these processes, regular account reconciliation brings significant advantages.

It gives accountants a streamlined way to verify that their balance sheets are correct, appropriate, and compliant. The software receives information from banking institutions and compares it against internal records. This saves time and improves the accuracy of balance sheets, income statements, and related documents. Xero is an web based intuitive accounts reconciliation software that provides multiple bookkeeping functionalities. This app can automate your reconciliation process while improving accuracy and transparency. Using this tool means automating your invoicing system and accepting online payments.